26+ Total debt to income ratio

Calculate your DTI with the following formula. Ad Consolidate 20000 or more.

Financial Ratios Calculations Accountingcoach Financial Ratio Debt To Equity Ratio Financial

The maximum can be exceeded up to 45 if the.

. In this formula total monthly debt payments represent. Ad Get Your Best Interest Rate for Your Mortgage Loan. Get Started in 5 Mins.

Expressed as a percentage a debt-to-income ratio is calculated by dividing total recurring monthly debt by monthly gross income. Then multiple 4 by 100 equals a 40 debt-to. Its a quick way to learn if you earn enough each month to confidently cover the bills.

For example if your household income is 5000 and your total monthly debts are 2000 divide 2000 by 5000 which equals 4. For manually underwritten loans Fannie Maes maximum total DTI ratio is 36 of the borrowers stable monthly income. Later use the Build a Budget tool to see how you can maximize your current earnings.

A debt-to-income ratio around 20-35 is usually best. This ratio is one factor. Debt to Income Ratio 5500 2440 443.

Now assuming you earn 1000 a month before taxes or deductions youd then divide 300 by 1000 giving you a total of 03. Monthly rent or house payment. Compare Quotes Now from Top Lenders.

To calculate your debt ratio divide the number in the Total Debt box by the number. Rebecca Lake Oct 26 2021. Add up your monthly bills which may include.

Get Offers From Top Lenders Now. Proposed monthly property taxes insurance and HOA fees 475. The total debt service TDS ratio measures how much of your gross income is being used to cover your housing costs and other debt payments.

What is a good debt-to-income ratio. Receive Your Rates Fees And Monthly Payments. 1 Low Monthly Payment.

Monthly alimony or child support payments. Your debt-to-income DTI ratio and credit history are two important financial health factors lenders consider when determining if they will lend you. Multiply your weekly before-tax income by 52.

Cut Debt by 50 or More. Understanding what the ideal debt-to-income ratio will help you with your financial future. Student auto and other monthly loan payments.

Divide the total amount that. For example if your total monthly debts. Total monthly debt paymentsGross monthly income x 100 Debt-to-income ratio.

Generally most lenders maintain a maximum 43 debt to income ratio to get a mortgage. Total debt divided by gross monthly income times 100. The Debt to Income Ratio Formula.

Write in your gross annual income. Borrowers with debt to income ratios that are higher than 43 may not be able to. Lets say you have a total monthly debt.

The DTI guidelines for FHA. To get the percentage youd take 03 and multiply it by 100. Be Debt-Free Faster Than You Think.

Calculate your DTI by dividing your total monthly debt payments by your total monthly gross income your income before taxes. Total Monthly Obligations 2440. Get a Quote Today.

Tuesday Tip How To Calculate Your Debt To Income Ratio

Debt Ratio Formula Calculator With Excel Template

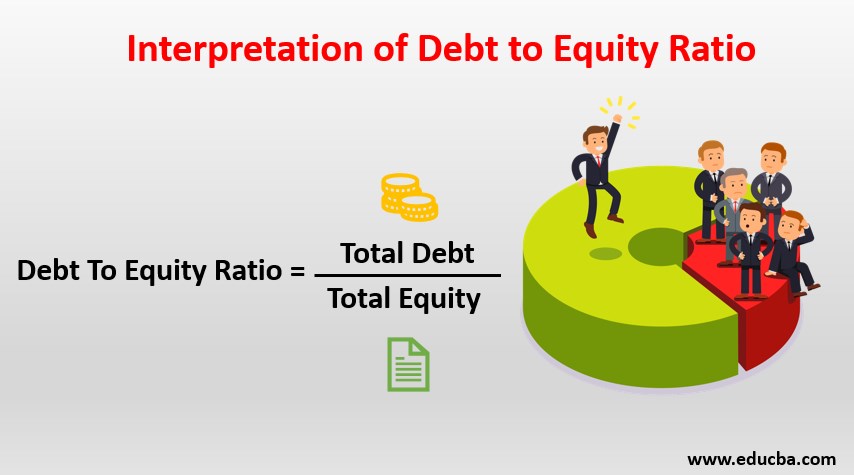

Interpretation Of Debt To Equity Ratio Importance Of Debt To Equity Ratio

1 Stop Mortgage First Time Home Buyers Mortgage Real Estate Values

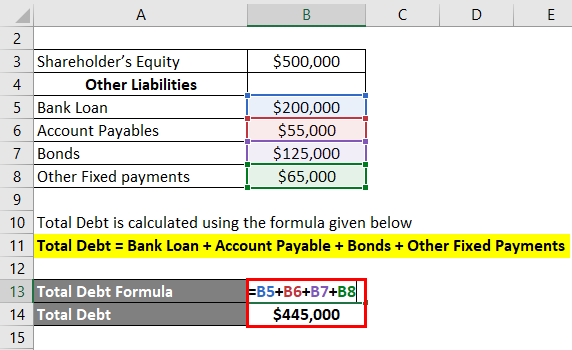

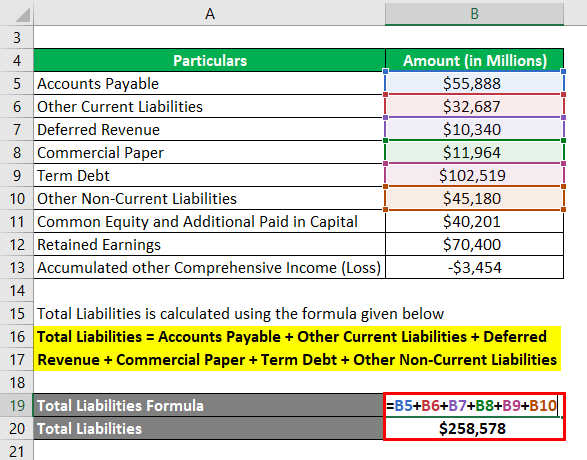

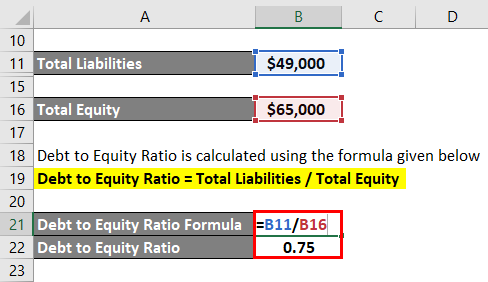

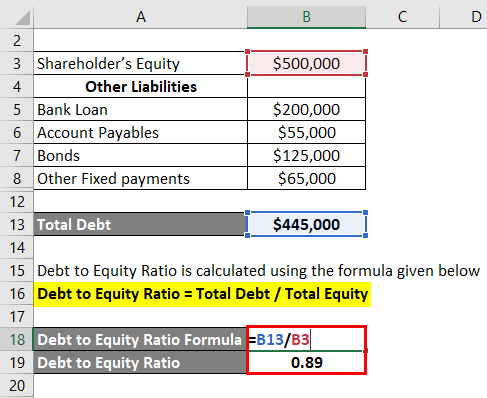

Debt To Equity Ratio Formula Calculator Examples With Excel Template

Debt To Income Ratio Formula Calculator Excel Template

Debt To Equity Ratio Formula Calculator Examples With Excel Template

Interpretation Of Debt To Equity Ratio Importance Of Debt To Equity Ratio

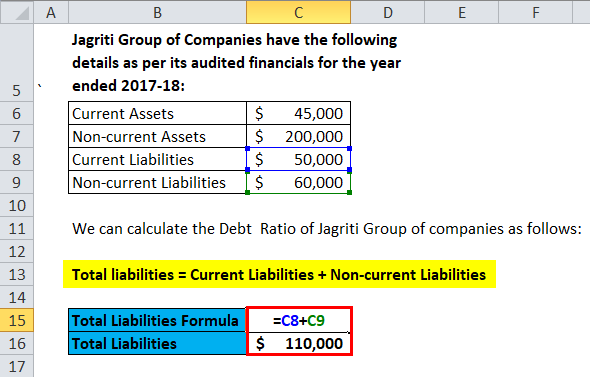

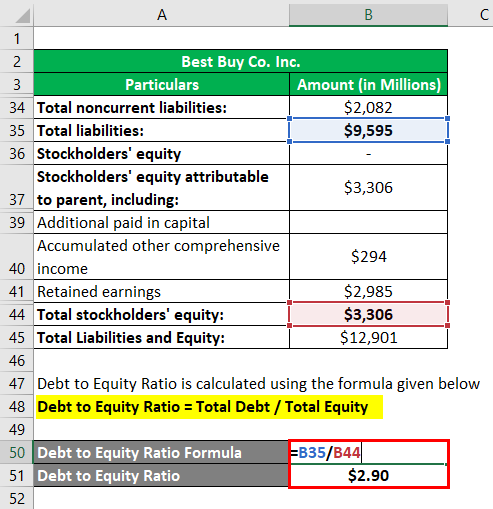

Debt Ratio Example Explanation With Excel Template

Debt Ratio Formula Calculator With Excel Template

Debt To Income Cheat Sheet In 2022 Debt To Income Ratio First Home Buyer Income

Debt To Capital Ratio Formula Meaning Example And Interpretation Debt Raising Capital Equity Capital

Interpretation Of Debt To Equity Ratio Importance Of Debt To Equity Ratio

Debt To Equity Ratio Formula Calculator Examples With Excel Template

Debt To Income Ratio Can You Really Afford That Car Or Home Money Life Wax Debt To Income Ratio Student Loans Student Loan Help

Debt Ratio Financial Ratio Bookkeeping Business Debt Ratio

Interpretation Of Debt To Equity Ratio Importance Of Debt To Equity Ratio